How to Build Expense Tracking App (Features + Benefits + Best Apps)

Most people find it very difficult to manage money. 26%, more than a quarter of Canadians are struggling with their finances. In the USA, 45.5% of people do not have any savings for their retirement. They will essentially be broke when they retire.

Business people find it even more difficult as their income varies every month, unlike salaried people, making it even more important to maintain a budget. Expense tracking apps help to keep track on income, track receipts, create a budget, track income vs. expenses, manage taxes, sync cards and do a lot more with complete security.

Table of Contents

No matter what, there is some sort of discrepancies while managing money, whether personal or business. You are very careful but something or the other happens and you lose track of one transaction and it is done.

Even if you’re great with money and account keeping, it is always difficult to have a complete grasp of your business’s finances. With handling an enormous amount of information like receipts, bills, sales data, refunds, taxes, payrolls, it is not a surprise that you make mistakes.

It doesn’t matter if you own a wine shop or run a chain of restaurants, the finance management problems you face are the same. In fact, people have carried out studies showing that more than a quarter of Canadians are struggling with finances.

We have some facts that will show the magnitude of this problem.

Importance of Expense Tracking

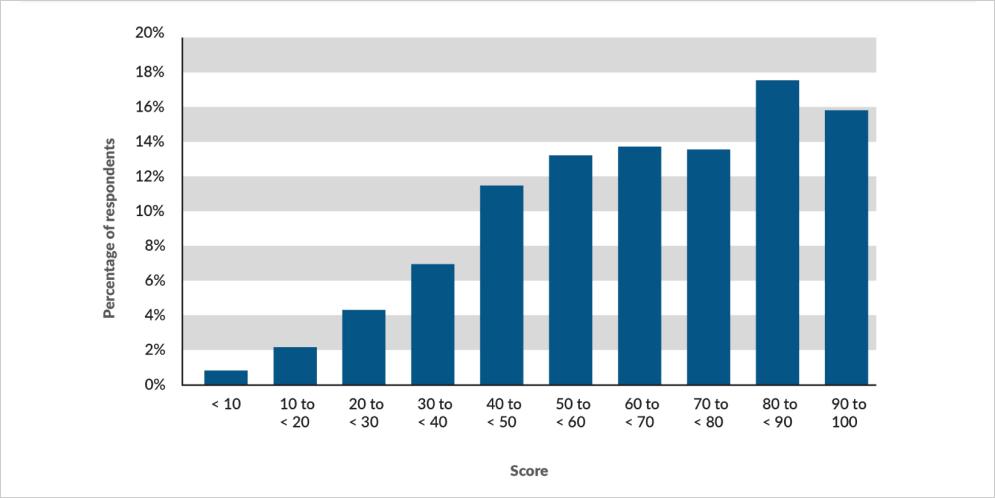

- According to a survey, 26% of Canadians had a Financial Well-being Score of less than 50.

- Out of this 26%, about 19% have a score between 31 and 50 and are somewhat struggling while 7% have a score of less than 30 and are struggling a lot.

Source: canada.ca

- The study also said that Canadians who actively save have higher levels of financial well-being than those with the same income who don’t.

- In fact, intentionally setting money aside is the variable most strongly related to financial well-being, regardless of income level or other demographic influences.

- In the USA, 45.5% of people do not have any savings for their retirement. They will essentially be broke when they retire.

Source: GBR

These facts suggest how serious it is to save money. These problems arise as people do realize the future repercussions of not tracking money.

We have some good news for you. It doesn’t have to be this way at all. Technology is here to help you stop wondering where the money went. We are talking about the best expense tracker apps that understand your business- inside out, tracking each transaction.

Let us take you through your own story in this segment. The problems you face every day while you try to manage your budget and finances and how expense tracker apps can help you.

How Can Expense Tracker Apps Manage Your Finances Smoothly?

Tracking Receipts

The first problem with tracking expenses is that you cannot find the receipts of the digital and cash payments you made. You can see a debit of 500 bucks but do not remember where or on what did you spend it.

As hard as it sounds, if you want to know exactly where your money goes, you must be able to track receipts dating back 3 months or sometimes even more.

It doesn’t feel feasible and it is rightly so. This is where the role of a business expense tracker app comes in. You can store all the receipts by just clicking their pictures in your expense management app.

Managing Documents

If you’re still using excel spreadsheets and paper to keep track of your digital transactions and cash payments, it is time to stop.

Using paper is not only more difficult to manage but also much more harmful to the environment. It is not uncommon to misplace files or lose them. Money management software provides a digital solution to this problem. Everything is stored on the cloud so nothing is lost.

Excel sheets may provide a digital solution but do very little to help in money management. Further, they do not have the advanced functionality of preparing accurate graphs and charts automatically. In fact, the best tracker apps derive insightful conclusions from the data which can be useful in making business decisions.

Reduce Human Errors

To err is human.

But when it comes to managing finances and budget, you can not afford mistakes. The truth is that humans are bound to create some errors due to negligence, carelessness, or misunderstanding.

Using a expense management software will reduce and even prevent any mistakes caused due to bias and negligence. Everything will be stored in one place which helps in retrieving data at any time needed, helping humans to make the best use of expense tracker apps.

Whether it is an expense tracker app for small business or big, it will automate the workflow. Thereby, allowing real-time monitoring of processes so that errors can be checked quickly.

Prevent Frauds and Data Losses

With manual personal finance and expense management, you can not check the details of every transaction with complete accuracy or focus. This is the reason, fraudulent cases are fairly common without proper monitoring.

The workflow of financial and money management, with the help of the best expense tracking and budgeting apps, becomes automated. This lets the process be more transparent and precise, preventing fraud.

For securing data, there are functionalities like conditional access. This way sensitive information is available only to relevant employees.

Provide Proper Analytics

Excel sheets might record and store data and build useful graphs or charts from it but still lack some important functionality. You need to analyze this data and derive conclusions yourself.

Again, with human involvement, the probability of errors in conclusions increases manifold. Best business expense tracker apps carry out prediction analysis helping you create effective business decisions.

Yes, you can use a finance tracking app to budget money for your business activities and track sales, profits, manage inventory and also predict future expenses. A personal finance app lets you handle approvals, reimbursements, and other processes as workflows.

A personal expense tracker app to manage personal finance sounds like a good investment now, doesn’t it?

You might be wondering about the reasons to get a custom expense tracker app instead of already available options in the market. The point of an expense tracker or personal budgeting app is to save money, why spend money on creating it, right?

We will get to the reasons, but let’s first talk about the best expense tracker apps in the market.

5 Best Expense Tracking Apps

To give just one name is not possible. There are a number of spending tracker apps available in the market that are good for various purposes. We have a list of the 5 best expense tracker apps along with their features, pros, and cons.

| Name Of The App | Features | Play Store Link | App Store Link |

|---|---|---|---|

| Personal Capital |

| ||

| QuickBooks |

| ||

| ClarityMoney |

| NA | |

| Wally |

| NA | |

| Mint |

|

Personal Capital – Investment Tracking App

Personal Capital is a financial management tool available. It actually has two versions, a Free Financial Dashboard and a Wealth Management service. The free version is basically a budget tracking app and provides some tools for investing. On the other hand, the wealth management version is an investment management tool, with robo-advising service. Personal Capital lacks certain functionalities and isn’t as good in budgeting and bill pay.

If you want a human advisor, Personal Capital offers access to human advisors for a management fee that starts at 0.89% and a minimum balance of $100,000 in your account. It is a bit too expensive for most people.

Source: Personal Capital

Pros Cons - Hybrid digital wealth adviser

- Nimble

- Fiduciary advice.

- Higher fees

- Requires manual tracking

- No promise of outperformance

Clarity Money-budgeting App

Clarity Money is an expense tracking, budgeting and bill negotiating app. It allows you to link your checking and credit accounts, credit and debit card, control bank account and categorize all your transactions in a single spending tracker app. It organizes your transactions into graphs that include daily spending trends and pie charts.

It has a few shortcomings too. Clarity Money promotes automated savings, but they don’t force you to come up with realistic spending patterns. It is not suitable for business owners as it is meant for people who have fixed regular income.

Source: Clarity Money App

Pros Cons - Free version of this expense tracker app available

- Clarity Money is easy to use

- Product recommendations

- Track credit score

- Not all financial institutions are supported

- Some functions are only available on iOS

- No bill negotiation

- No personalized coaching

- Less customizable

QuickBooks-accounting App

QuickBooks is accounting software for small businesses. It manages spending and finances with either a licensed or online version. It gives instant access to customer, vendor and employee information. QuickBooks finance tracker app starts with a $5 per month base price but does provide free support and upgrades with the online version.

Actually, the Online Simple Start plan costs $25 per month if you need the most basic functions. While the Advanced plan reaches $150 a month. If you need more features, it cost extra per feature.

Source: QuickBooks

Pros Cons - QuickBooks app is easy to use

- Efficient

- Good accounting reports

- Flexible with 3rd party apps

- Affordable price

- Lack of industry and business-specific components

- Lack of key reports

- Instability as the system crashes

- No direct professional support

- File-size issues

- Number of users limited

Wally-personal Finance App

Wally is said to a budgeting app for millennials. It claims to be an easy to use, seamless, and intuitive tool to manage personal finance. It promises to give a 360 view on your money.

Wally finance tracking app provides the tools to understand where the money goes and empowers to set and achieve financial balance goals. Wally is also the best app for tracking expenses and receipts.

That’s where its benefits end. It is a personal finance app and is not suitable for small or big business owners. It is far from a fully-featured budgeting tool, you can’t set budgets for individual categories.

Source: Wally App

Pros Cons - Total control

- Good for budgeting

- Safe and sound

- User-friendly

- Manual data entry

- Time-consuming

- Some features are paid for

Mint-budgeting App

Mint is a popular app like Personal Capital. It claims to be the one place to supervise all finances, sync bank account and is easy to use. It has a feature that sends bill pay reminders so and helps avoid missed payments and credit card fees. Mint helps manage incoming and outgoing money flow and find savings along the way.

It is still quite simple and primitive but lacks the advanced functions of other expense tracker apps. Mint is good for budgeting but has little use for investment and retirement planning. Mint is also known as the best free expense tracking app in Canada because of its multiple uses.

Source: Mint App

Pros Cons - Easy to use and set budgets

- Easy to keep track of progress

- Insight into spending

- Too many ads

- Purchases are not updated quickly

- Wrong categorization

Moving on, here are some compelling reasons you need to develop a custom expense tracker app for tracking your business expenses.

Why Go for a Custom Instead of Ready-made Expense Tracker Apps?

Fulfills Requirements

Ready-made personal budget management apps have a specific set of features for all users. The spending tracker apps do not account for the users’ income, source of income, business or job, social status before integrating features.

The features and functionalities are the same and easy to use for all. This means there might be some functionalities that are pretty useless for you. Further, the opposite might also stand true.

These spending tracker apps lack features that may be essential to track the finances of your businesses specifically. Ready-made spending tracker apps are not made to cater to your particular needs.

This is the biggest drawback of readymade expense tracker apps. Custom spending tracker apps have the advantage of being tailored especially for your business requirements.

As a plus point, there are no unnecessary features. There is no secondary purpose, they are meant to track your finances- nothing else.

No Notifications

Most, if not all, of the ready-made personal finance tracking apps, have the same agenda. They need to earn money. This is why they show a lot of advertisements- either of some insurance company or a bank or even online shopping.

The expense tracking apps, no doubt, tell you when you’re overspending but such important information may get overlooked by other trivial notifications. Basically, losing the point of a self budgeting app.

Custom expense tracker apps for small business do not dwell in such activities. They are totally focused to provide you with the best expense tracking and management solutions.

Time-saving

Yes, they promote their expense management apps saying they would save your money as well as time. This is far from the truth. You will have to spend at least an hour a day scrutinizing every financial transaction.

Oh, and if there is a mistake like misclassifying or duplicating transactions, this time increases. How would a financial tracking app save your time this way? A custom expense tracking app, on the other hand, saves your time as the chances of such mistakes reduce considerably.

Provides Security

The best financial tracking apps like Mint, PocketGuard, Wally claim to be totally secure. Yet they have garnered media attention every now and then.

No matter what, there is always a chance of fraud when it comes to third-party finance management apps. These finance tracking apps require sensitive information like bank account numbers, credit card information, sales reports. This makes it even riskier as any issues in the third party server can make your data vulnerable.

Hackers can hack into the servers leaking your data to malpractices. We believe you already understand the intensity of this issue. A custom personal budget planner app saves you from these risks.

All your information is safe with you and authorized personnel only. The probability of data loss and fraudulent activities is lessened substantially.

It would be pretty ironic if you lost sensitive data and money in order to save a little money by using ready-made business expense management apps.

Still think ready-made apps are worth risking your data just to save a little money?

Get rid of this risk.

Before you find some developers to build your expense tracking software or mobile app, understand your needs and which functionalities you need in your finance tracking app. It is not necessary to know all the details, but a brief idea won’t hurt.

Here, we have some features of expense tracker apps that you help in tracking and managing your business expenses.

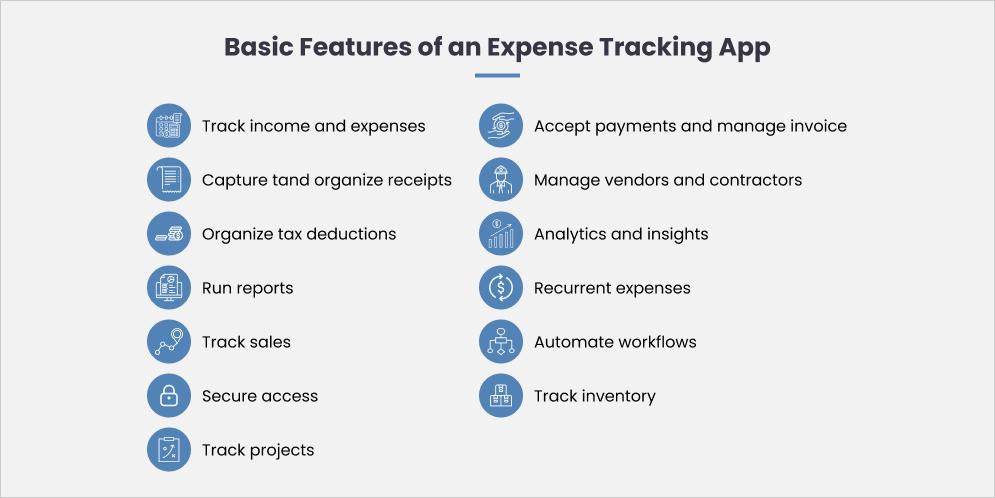

13 Expense Tracker App Features to Include in Your App

Let’s check each expense tracking app features in detail mentioned in the above image.

Track Income and Expenses

This goes without saying. The main feature of an expense tracker app is monitoring income closely and keeping a check on expenses against it.

You can easily import transactions from your bank, credit card, mobile wallets without risking your information.

This gives a clear image of how much you are making and how much you are spending. You can easily have an idea if your spending habits are feasible or in accordance with your income.

Capture and Organize Receipts

You tend to miss out on adding certain transactions or forget about some expenditures altogether. This problem is solved with this component.

You just need to capture an image of the receipt every time you do or receive a digital or cash payment. Put it under the appropriate category and the spending tracker will make sure you don’t forget it.

The images are stored on a cloud and you don’t lose it either. In fact, the receipts are organized in such a way that you can retrieve them any time you want.

Organize Tax Deductions

When it comes to filing taxes, just import your document to finance tracking app. The app will easily organize income and expenses into tax categories.

Spending tracking apps will sort your business expenditures into the appropriate tax categories, helping you keep more of what you earn.

Accept Payments and Manage Invoice

The expense tracking app will accept credit cards, debit cards, net banking, and bank transfers directly in the invoice. You can also track the status of your invoices and credit card bills from the app itself.

The app sends payment reminders and automatically matches payments to invoices. If you want you can also create professional custom invoices with your logo that you can send from any device.

Run Reports

The daily expenses app also lets you generate and run reports of profit & loss, income, expenses, and balance sheets. You can also create a custom report so that you get important insights about your individual business needs.

If needed, you can for advance reports and generate budgeting and inventory reports.

Track Sales

Use your expense tracker app as an e-commerce solution as well. You can accept credit cards by integrating a feature of a mobile card reader and also have an option to sync with popular apps.

You can also connect to e-commerce APIs that you prefer using. The finance tracking app automatically calculates taxes on your invoice.

Manage Vendors and Contractors

You can add details of vendors and contractors in the app and assign them categories. Also, keep track of all the payments you have made to these vendors- who, how much and when you have made the payments.

Secure Access

You are not going to handle all the transactions yourself, you can give your accountant secure access to your books. You can also give specific access to certain functionalities of the expense management software to reduce errors.

The best budgeting apps help in assigning work to particular users and increase your team’s productivity. Moreover, you may create custom permissions for deposits, sales transactions, expense reports, balance sheets, take care of personal capital and more.

This helps the entire team to stay on the same page by sharing reports yet, without compromising the security of sensitive data.

Track Projects

Best budgeting apps let you keep track of the activities of all your projects, all in one place. Further, you can track your resources that are being utilized on the various aspects of your project.

You can keep track of labour costs, payroll, and expenses with job costing. This leads to determining project profitability with just one glance on the dashboard and reports.

Track Inventory

People develop special inventory management software for their business but your expense tracker app for business can track your inventory for you.

This one helps track products, cost of goods, and sends alert notifications when inventory is running low on a product. You can also see which product is popular and which is not selling as per the need.

The expense tracking app lets you create purchase orders and handle vendors as well. In fact, you can directly import from the existing spreadsheet so you don’t have to put all the details again.

Analytics and Insights

This feature lets you create presentation-ready and customizable reports which also have easy-to-understand visuals and graphs. You can also analyze these reports to generate insights.

The best budgeting apps also come with in-depth analysis tools using which you can see how well your business is performing. You can also compare the past and present reports and predict future sales.

Recurrent Expenses

The best budgeting software can also track certain bill payments and vendor transactions that occur at regular intervals. You can give access to the app to take care of such recurrent expenses.

This will streamline and automate repetitive expenses, checks, and invoicing tasks.

Automate Workflows

This one saves a ton of your time that you would usually spend in making reports, sharing and analyzing. You can configure reminders that send alerts based on the needs of your business solutions.

These automated reminders also improve sales, client relationships and cashflow.

These functionalities are there in most of expense managing apps depending on the requirement. Yet, if there is a special need that you need, you can have unique functionalities catering to your demands integrated into your app.

4 Unique Features for Expense Tracking App Development

Micro-investing

This feature helps to start investing in small amounts. You can understand that small savings add up without the pain of having to think about larger investment solutions. You can automate monthly or manual investments according to your account balance.

Robo-investing

This feature generates algorithmic investment solutions and works to analyze, monitor and improve diversification in investments. You can optimize portfolio data, and quickly turn that big data into actionable, and unbiased investing insights.

It is difficult to get unbiased financial advice but with Robo-investing, this problem get solved easily. In fact, for amateur investors, we have developed a Paper Trader app that lets users trade real stocks in real-time with real prices without risking any actual money.

Budget vs. Actual Spend

Most expense management apps show the difference between income and expenses. This is no doubt useful but to get detailed insights, you need to see the complete picture.

This is why you must also have complete details of what is the budget and how much is being spent in real-time. This helps in following the budget and preparing solutions like cutting off unneeded expenses.

Credit Check

Initially, you needed to pay TransUnion or Equifax about $20 to get your credit score. All this is not needed with this feature. This feature displays current credit score, updated weekly, from both TransUnion and Equifax and gives the score a rating, such as fair or good.

Advancement in the same component will send credit score change alerts via push notifications and personalized recommendations for credit products, based on your current credit score.

Technology never fails to surprise us. Don’t be surprised when we tell you about humans would probably have nothing to do with expense management or finance solutions. Artificial Intelligence will take over for good and leave no room for error.

There are some AI-based features that we can develop to enhance the understanding of your spending pattern.

4 AI-based Features to Develop in an Expense Management App

Chat

AI-chatbots are great and intuitive messaging interfaces. You do not need to learn how to use other apps. You can easily talk to the bot, just like you do with your friends. This bot will be fully equipped to understand your queries and needs.

You might find this feature in an expense tracker app for family or couples to keep a check on account balance.

This makes the user experience very smooth. Imagine a bot suggesting to you how to save money. That can be done!

Prediction

Taking prediction analysis up a notch with this feature. AI learns about your finances, spending behaviour, and predicts your next purchase.

After this, it can come up with unique insights on how you can save more money and stretch your paycheck. From where to spend and on how much to spend, you will know the event the smallest factors that are causing the fluctuations in your expenses.

You know there is no scope of human error here, it is a totally safe solution!

Discounts

This feature helps you save by offering discounts on the things you need based on your preferences when you need them. It also finds and displays exclusive discounts on items you are already likely to buy or discover less expensive alternatives for similar items close to the time of purchase.

Basically, the finance tracking app does not only tell how you to save money but actually gives you solutions to save it.

Travel Budgeting

If you have experienced that employees exploit their business trip allowances, these are the solutions you are looking for.

Travelling budgeting feature helps in preparing a budget before an employee is sent on a business trip. You can add the travel destinations and get a chart or graph prepared according to them.

You can then allocate resources based on the predicted travel expenses. This way you will save a lot of money spent on business travels.

Thus, your spending tracker is also the best app for business travel expenses and budgets.

Want to develop the best expense tracking app with all these features and functionalities?

We know that was a lot of information. Here is a quick recap video for you before you start building your own app.

FAQ for Expense Tracking Apps

How can I track my expenses?

Tracking expenses is not an easy task, but there are a few simple steps that you can follow to track your spending and transactions.

5 Steps to tracking your expenses:

- Scrutinize your account and personal finance statements

- Check your money habits

- Track credit card and debit card expenses

- Classify your expenses

- Find out expenses you can lay off or reduce

What is the best app for personal finances?

Some of the best budgeting apps for personal finance are:

- PocketGuard

- Wallet

- MoneyStrands

- Fudget

Are budgeting apps safe?

If you are using a reputable expense tracker app, there is not much need for worry. According to most app reviewers, they are considered pretty safe as they have read-only accessibility of your data but this might hinder their functionality. These apps do not misuse your data but there is a chance that your data might get leaked if someone hacks the third-party server.

Custom expense tracker apps are safer as you have authority over all the data and access to the server.

Are expense tracking apps from your personal bank or apps like Mint accurate in categorizing one’s expenses?

Personal bank apps make good guesses when it comes to categorization but only after heavy customization. The good part is that bank apps and expense trackers have settings to update categories and change mislabeled expenses. This helps in future categorization.

It is preferable to record all the transactions manually for better accountability.

How do you control your expenses?

When you have an expense tracker app with advanced functionalities, it can automatically help you control expenses. Here are some other suggestions:

- Track your high expenses

- Track receipts and bills

- Track your debts

- Analyze the insights from app

- Check the future predictions

- Make strategies to lay off unneeded expenses

- Manage taxes and loans

Start Saving Now

In the end, everything comes down to money. You are running a business to earn as much profit as you can. It is very normal, and that is how it should be.

If you are unable to track your spending, it can lead to huge losses in the long run. It might seem a small expense now but when such small expenditures accumulate, it will impact the business in a harmful manner.

This has made it supremely important to oversee your expenses. Not only manage, but you must also cut off certain things and leave the attitude of lending and borrowing too much money.

Saving money is good, investing is even better. Of course, you need to understand stocks and equity before that. We will not get into too many details of that. But when it comes to tracking expenses, we can be a great help.

We are a mobile app development company based in Canada. We have worked with clients all over the world and developed applications of various categories, financial apps being one of them.

Known for our fully-equipped and user-friendly apps, we have garnered good reviews from our clients as well. We have expertise in Android and custom iOS application development. We also develop web apps and software with the same passion and quality.

If you have any questions about the expense tracker app cost, timeline, process or any other query, we are more than happy to guide you. Feel free to ask for a free of charge consultation from our expert. All you need to do is fill-up the contact us form given in the footer and one of our sales representatives will reach out to you with 48hours.

Want to Develop an Expense Tracking App?

Editor's Choice

Insurance App Development: Features, Costs & Best Practices for Businesses

Healthcare IT Outsourcing: The Complete Guide for Hospitals, Clinics, and Healthtech Startups in 2026

How to Build a Personal Finance App: Complete Guide

All our projects are secured by NDA

100% Secure. Zero Spam

*All your data will remain strictly confidential.

Trusted by

Bashar Anabtawi

Canada

“I was mostly happy with the high level of experience and professionalism of the various teams that worked on my project. Not only they clearly understood my exact technical requirements but even suggested better ways in doing them. The Communication tools that were used were excellent and easy. And finally and most importantly, the interaction, follow up and support from the top management was great. Space-O not delivered a high quality product but exceeded my expectations! I would definitely hire them again for future jobs!”

Canada Office

2 County Court Blvd., Suite 400,

Brampton, Ontario L6W 3W8

Phone: +1 (437) 488-7337

Email: sales@spaceo.ca